golden state tax training answers

We strive to look for new and responsive ways to make your QE and CE. Let me give you a short tutorial.

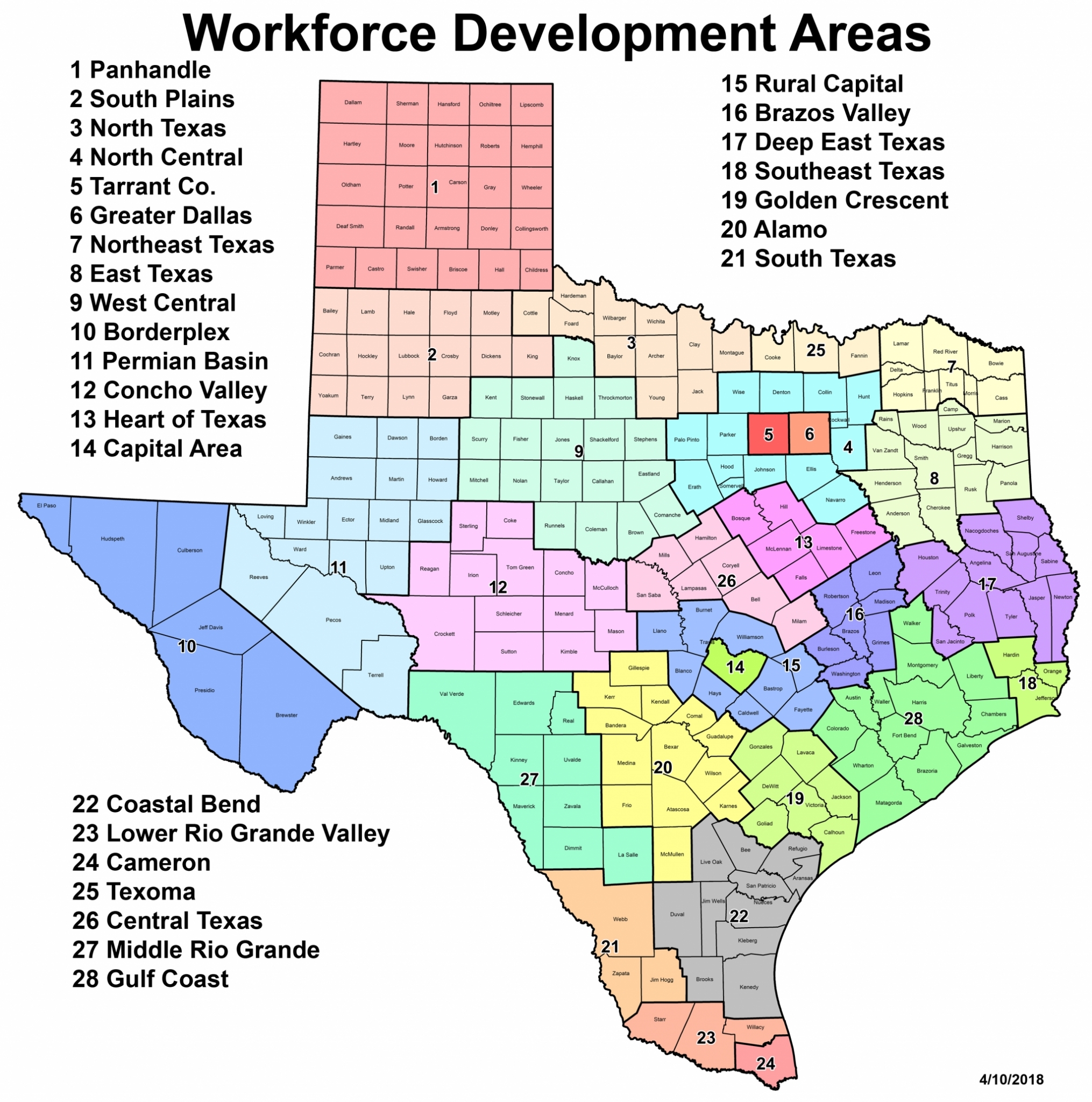

Workforce Solutions Rural Capital Area Where Business Careers Meet

Golden State Tax Training Institute has been a CTEC approved provider for both Continuing Education for over 30 years and we have a course that will meet your requirement.

. Pass or dont pay. Golden State Tax Training -. 6 hour Annual Federal Tax Refresher Course AFTRC with comprehension exam.

Golden state tax training answer key provides a comprehensive and comprehensive pathway. Golden state tax training answers. Schools offering Certified Tax Preparer.

Enter your Username and Password and click on Log In. We focus on customer service and satisfaction. It contains 100 multiple choice and TrueFalse questions and a score of 70 is required to pass.

Go to Golden State Tax Training Institute Login website using the links below. Golden State Tax Training Institute has built a course using our 33 years of Tax Training experience. We are an IRS Approved and CTEC Approved Provider of continuing education and qualifying education CE and QE.

C Carl 31 and Carol 29 are using the married filing jointly status and have two dependents. Jackson Hewitt Tax Service. Help users access the login page while offering essential notes during the login process.

Study Guide for Maryland Tax Preparer Exam The Maryland DLLR requires individual tax preparers to pass a competency exam. Since its founding in 1983 Golden State Tax Training Institute Inc. Golden State Tax Training Institute - CTEC Tax Training Continuing Education Courses.

Golden State Tax Training Answers - XpCourse. As always with the book option you have FREE access to the PDF course. 2 hours Ethics.

Golden State Tax Training Institute. About Golden State Tax Training Institute. Furthermore you can find the Troubleshooting Login Issues section which can answer your unresolved problems and equip you with a lot of relevant information.

Golden State Tax Business Service 5701 Lonetree Boulevard 309 Rocklin CA 95765 Phone. Other schools like Golden State Tax Training Institute. Her California gross income is 24000 and her AGI is 21000.

CTEC IRS Registered Tax Return Preparer RTRP 20 hour. Get traffic statistics SEO keyword opportunities audience insights and competitive analytics for Goldenstatetax. Since its founding in 1983 Golden State Tax Training Institute Inc.

Furthermore you can find the Troubleshooting Login Issues section which can answer your unresolved problems and equip you with a lot of relevant information. We provide high quality and cost effective courses for Tax Professionals since 1983. To date we have issued over 25000 courses to approximately 6000 individual tax preparers with the goal.

Furthermore you can find the Troubleshooting Login Issues section which can answer your unresolved problems and equip you with a lot of relevant information. You can take the course and fax or mail in your answer sheet or complete the exams online whichever you prefer. Either you pass or you get your money back.

2021 Golden State Tax Training Institute Inc. SupportContact Us 100 Money Back Guarantee. If there are any problems here are some of our suggestions.

As it is Federal and State Tax laws and as a tax preparer you want the best for your clients. Help users access the login page while offering essential notes during the login process. Has sought to streamline and simplify your California Tax Education Council CTEC continuing education CE requirement.

Enroll In Taxation Courses Today. A Anne 66 is single and has no dependents. Our 100 money back guarantee.

Help users access the login page while offering essential notes during the login process. 10 hours Federal Taxation. The detailed information for Golden State Tax Training Institute Login is provided.

The detailed information for Golden State Tax Training Login is provided. Golden State Tax Business Service QuickBooks Training. Golden State Warriors Basketball Academy.

We will email your certificate unless you mark the box stating you want it mailed. Includes 2 practice exams. Her California gross income and AGI is 17000.

Refund Policy - Upon request and return of the course for any reason prior to completion of your exam within 60 days of purchase. View Golden State Tax Training - Your 1 Continuing Education Providerpdf from CIS MISC at DeVry University Keller Graduate School of Management. B Betty 43 is filing head of household with one dependent.

The second option is our 6495 Traditional Book which we send by USPS. Look and Feel of the real exam. Our study guide will prepare you to pass the exam.

Our program is fully contained and includes all forms tax. The detailed information for Golden State Tax Training Login is provided.

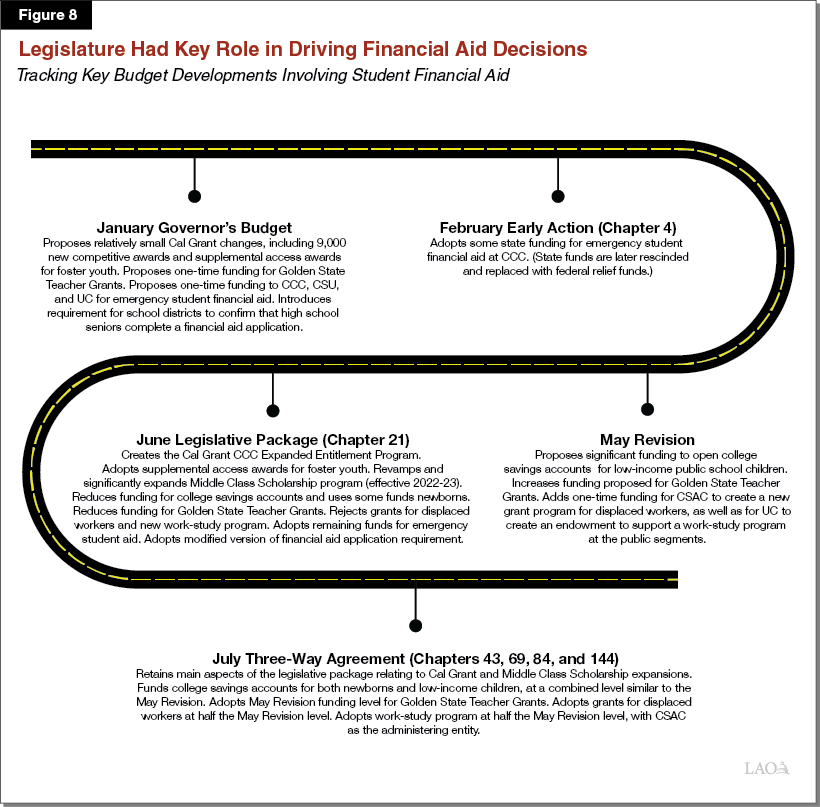

The 2021 22 Spending Plan Higher Education

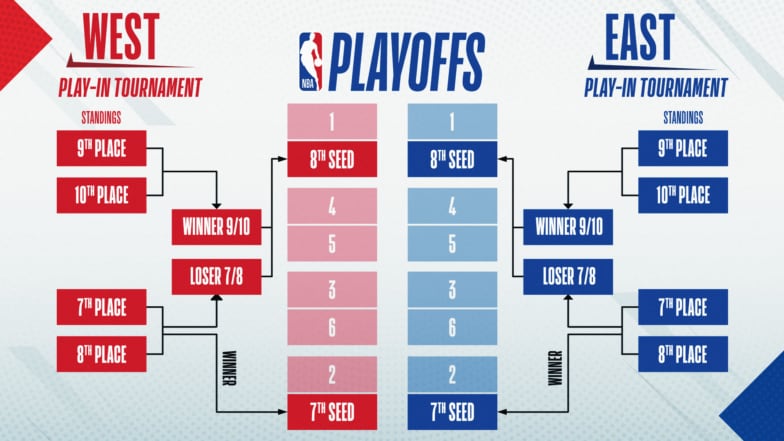

Things You Need To Know About The 2020 21 Nba Season Nba Com

Nra Ila Canada S Gun Confiscation Scheme Still More Questions Than Answers

Are Payroll Deductions For Health Insurance Pre Tax Details More

Tax Considerations For Online Training Nasm

Comprehensive Tax Course The Income Tax School

The Budget Center S First Look Analysis Of 2021 22 May Revision California Budget And Policy Center

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

6 Team Leader Interview Questions Updated 2022

Top 10 Tax Interview Questions With Answers

Deloitte Interview Questions And Answers Top 45 Deloitte Interview Questions Simplilearn Youtube

Private Schools Are Indefensible The Atlantic

Are Payroll Deductions For Health Insurance Pre Tax Details More

Rich People Are Getting Away With Not Paying Their Taxes The Atlantic